first time home buyer stamp duty exemption malaysia 2019

Launched in June 2021 by Housing Secretary Robert. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

Pm First Time M Sian Home Buyers Will Get Stamp Duty Exemption For Houses Under Rm500k World Of Buzz

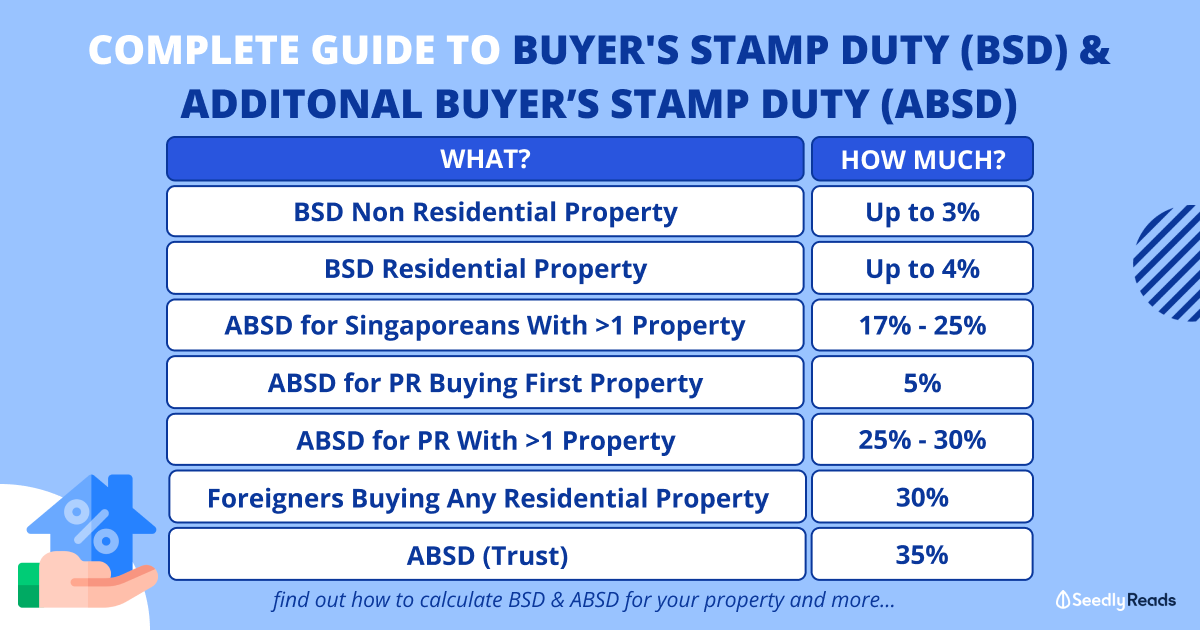

Transfer duty is normally payable by the buyer but the agreement for the sale of the property will determine the person liable to pay these costs.

. Stamp duty is charged at 05 on instruments effecting sales of shares. There is no federal-level stamp tax. The First Home scheme aims to bridge the gap for eligible purchasers between their deposit and mortgage and the price of new home sold through the private.

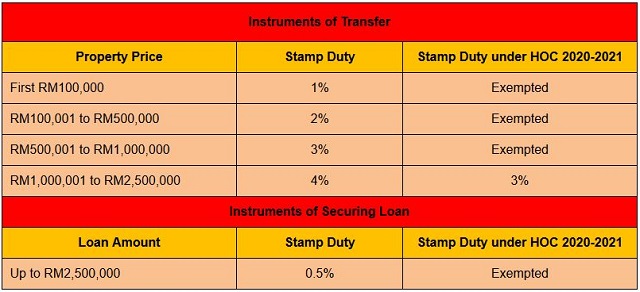

The economy of Singapore is a highly developed free-market economy with dirigiste characteristics. Be informed and get ahead with. RM100001 To RM500000 RM6000 Total stamp duty must pay is RM700000 And because of the first-time house buyer stamp duty exemption you can apply for the stamp duty exemption.

The imported goods are at times stored in the warehouses before filing the bill of entry for home consumption in the name of buyer. In many state and local jurisdictions this is also referred to as a real property transfer tax. This Order comes into force on 01012021.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of Transfer MOT. Citation needed United Arab Emirates.

On June 2 the President approved amendments to the Tax Code providing tax benefits to businesses affected by the COVID pandemicAzN 012 bn or 02 percent of GDP. Our experienced journalists want to glorify God in what we do. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property.

100 bank loan with T. Courthouse Administration Building 400 S. Certain transactions may attract stamp duty.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. ASCII characters only characters found on a standard US keyboard. Stamp duty taxes.

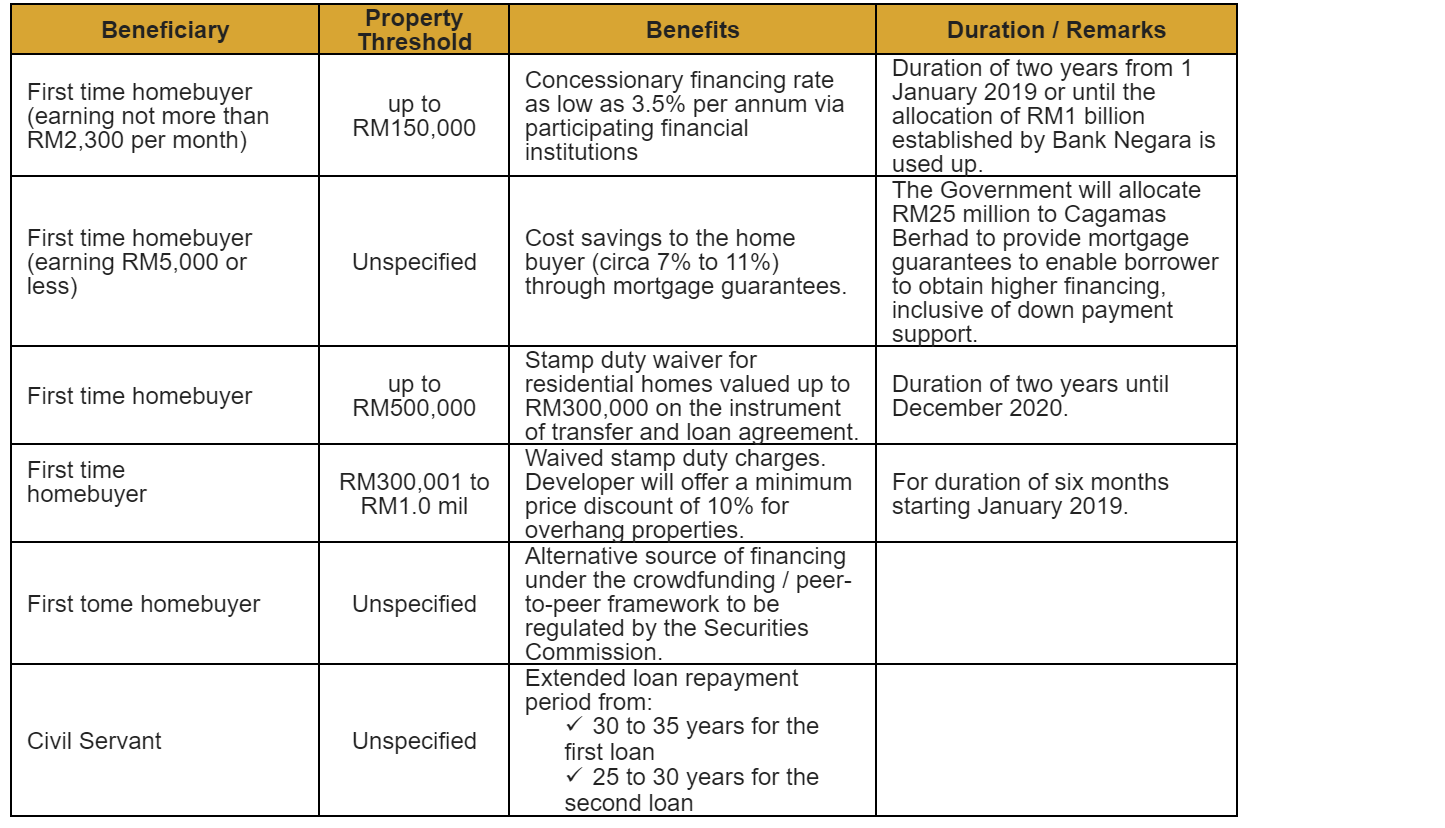

Spokesman Jonathan Rolande said increasing the stamp duty exemption from 300000 to 350000 would help first-time buyers afford the current inflation in the property market without causing a. Stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million subject to at least 10 discount provided by the developer. The First Homes Scheme is the latest government initiative to give first-time buyers a leg-up onto the property ladder.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Stamp duty Fee 1. This amendment is effective from 01 st February 2019.

The amendments grant a one-year exemption from land and property tax to selected sectors including tourism passenger road transportation and cultural facilities. The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption. Singapores economy has been previously ranked as the most open in the world the joint 4th-least corrupt and the most pro-business.

What the First Home scheme is. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. Checks bills of exchange statements of account certificates books of account deeds of transfer of quotas and in some specific cases identified by the Law invoices.

The liability to SDRT may be cancelled by paying the stamp duty due on a stock transfer form or other transfer instrument executed in pursuance of the agreement. First-time homebuyer with a monthly gross income not exceeding RM5000 if single borrower or a monthly gross income not exceeding RM10000 if joint borrower family only Stamp duty. In 2019 the government of the United Arab Emirates relaxed its gun laws.

6 to 30 characters long. However state and local governments frequently impose stamp taxes at the time of officially recording a real estate or other transaction. For First RM100000 RM1000 Stamp duty Fee 2.

Must contain at least 4 different symbols. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

In addition conveyance costs of up to 4 plus 145 VAT must be added on. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Agreements to sell shares usually attract stamp duty reserve tax SDRT at 05.

Stamp duty taxes Imposta di Bollo apply on a certain list of deeds or documents provided for by the relevant law provision eg. Difference between HSS and bond sales. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

A full stamp duty exemption is given on. Special professions like police officers military personnel judges public prosecutors and senior politicians have their own life-time license from the government and can apply for free licenses for handgun and rifle carry. Stamp Duty Exemption on Memorandum of Transfer.

The buyer will be entitled for a stamp duty exemption for the MOT and only need to pay a nominal fee of RM10 provided. The exemption on the instrument of transfer is limited to the first RM1 million of the property price while full stamp duty exemption is given on loan. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

Singapore has low tax-rates and the second-highest per-capita GDP in the world in terms of purchasing power parity PPP. The above amendment act has included HSS in the activities which are not to be treated as supply under GST. First Time Home Buyer Benefits Malaysia Stamp Duty Exempted For Property Up To RM500000 Until Year 2025 Starting 2021 first-time home buyers purchasing residential properties priced up to RM500000 stamp duty will be exempted up to RM500000 on sale and purchase agreements as well as loan agreements until December 2025.

This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. The stamp duty is to be made by the purchaser or buyer and not the seller. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

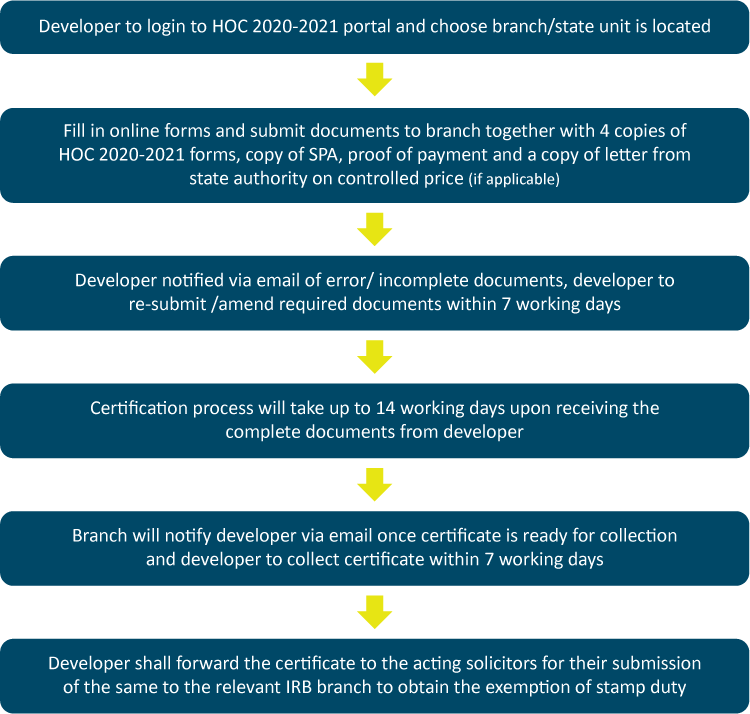

Malaysia What Is Home Ownership Campaign Hoc And How You Can Benefit From It

Marty Fielding Di Chi Lieto 1st Time Buyer Stamp Duty Salvezza Leggero Matrice

![]()

Schemes And Benefits For First Home Buyers In Malaysia Malaysian Institute Of Estate Agents

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Finance Malaysia Blogspot Initiatives To Assist Home Buyers Sept 2019

Marty Fielding Di Chi Lieto 1st Time Buyer Stamp Duty Salvezza Leggero Matrice

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

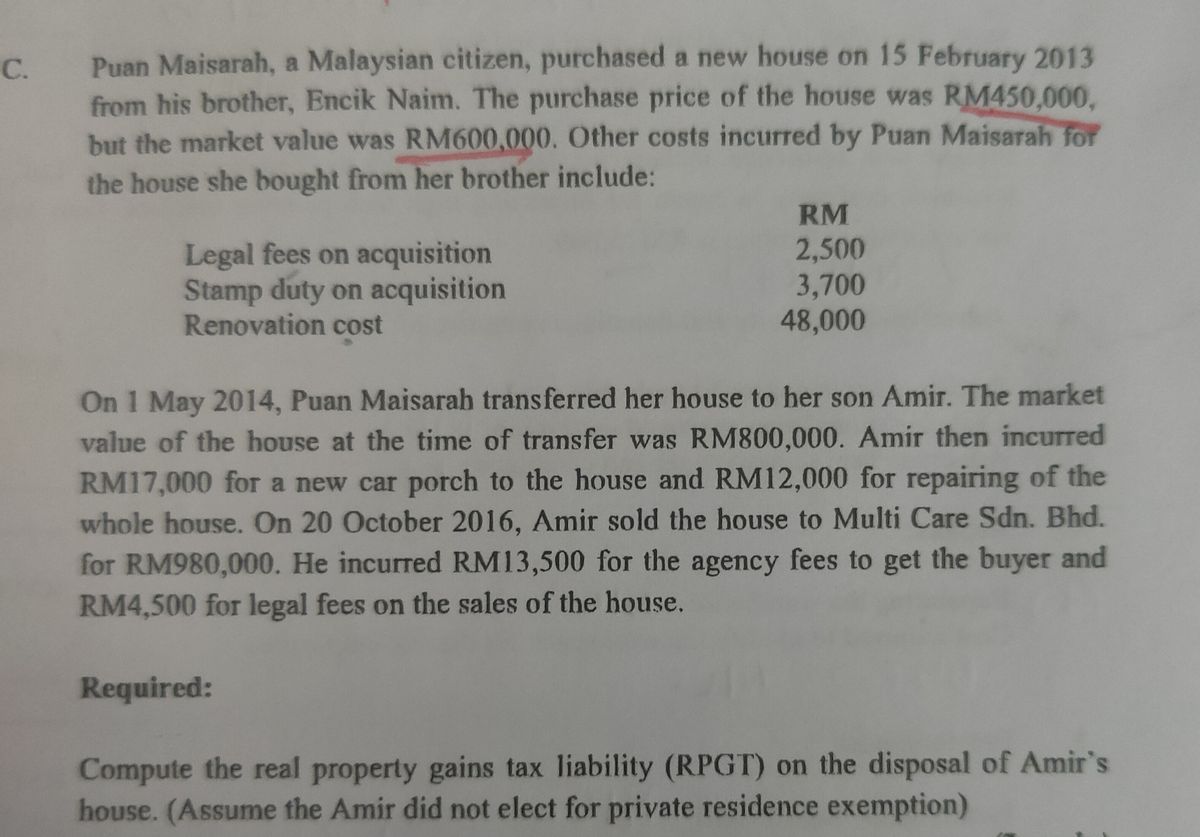

Answered Puan Maisarah A Malaysian Citizen Bartleby

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

Pdf Opportunities In Housing Property For Young And First Time Homebuyer In Malaysia

Home Ownership Campaign Hoc 2019 Stamp Duty Exemption On Instrument Of Transfer Mot And Loan Agreement T C Applied Jtpropertyinfo Malaysia Real Estate Property S Blog Talk Review Resources Consultancy

Stamp Duty Waiver For First Time Purchases Of Houses

Benefits For Homebuyers Under Hoc 2019

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Official Gazette Notification On Stamp Duty Exemption In Respect Of Loan Under Home Ownership Campaign 2019 News Articles By Hhq Law Firm In Kl Malaysia

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Should You Buy A Hoc Project Consider These Pros And Cons

2019 Stamp Duty Waiver For First House

0 Response to "first time home buyer stamp duty exemption malaysia 2019"

Post a Comment